Strong Rebound of US B2B Exhibition Industry Continues

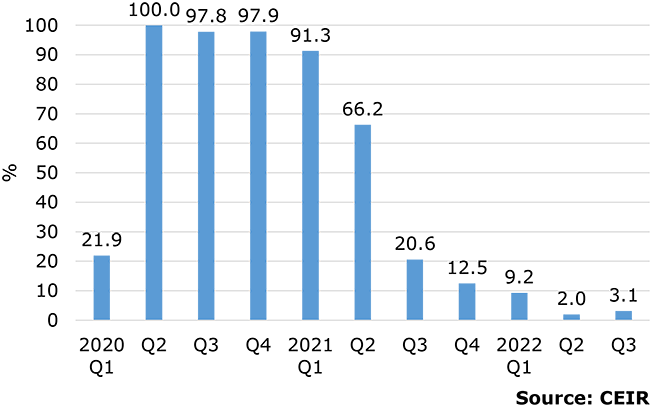

The Center for Exhibition Industry Research (CEIR) announced during Expo! Expo! IAEE’s Annual Meeting and Exhibition that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording a continued improvement in Q3 2022 from the previous ten quarters. The cancellation rate for physical in-person events remains low, although it increased slightly from 2.0% in Q2 to 3.1% in Q3. These rates are a substantial improvement from 97.8% in Q3 2020 and 20.6% in Q3 2021.

Figure 1: B2B Exhibition Industry Cancellation Rate, %

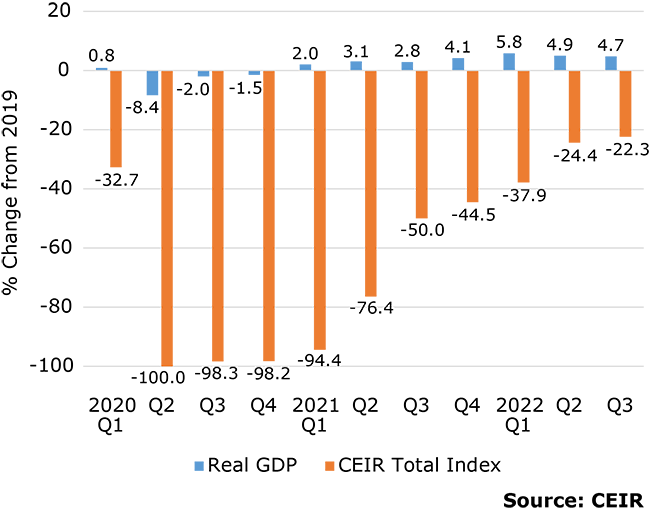

A relatively low cancellation rate and an improvement in completed events boosted the Q3 2022 Index result. As expected, the CEIR Total Index – a measure of overall exhibition performance – continues to recover, with a result 22.3% lower than 2019 as shown in Figure 2 below. Nonetheless, this is a vast improvement compared to the past two years, including declines of 98.3% from 2019 in Q3 2020 and 50.0% from 2019 in Q3 2021.

U.S. GDP and the CEIR Total Index

The performance of the U.S. economy was far better, registering a 4.7% increase in real (inflation-adjusted) GDP from Q3 2019 to Q3 2022. On a seasonally-adjusted annual rate (SAAR) basis, real GDP in Q3 increased 2.9% from the previous quarter, after two consecutive quarters of decline in Q1 and Q2. The rebound primarily reflected an acceleration in nonresidential fixed investment, upturns in government spending at all levels, and declines in imports that were partly offset by a smaller inventory accumulation, a larger decrease in residential fixed investment and a decline in consumer goods spending. Up to Q4 2021, economic recovery had been led by strong spending on goods. However, the initially sluggish recovery in services industries recently has continued to pick up the pace. In Q3 2021, real spending on consumer services finally recovered pandemic losses and robust expansion has continued since then. In Q3 2022, real spending on consumer services exceeded Q4 2019 spending levels by 3.3%.

Figure 2: Real GDP vs. CEIR Total Index, Q1 2020-Q3 2022, % Change from 2019

Q3 2022 Exhibition Industry Performance

Of all shows originally scheduled to be held in Q3 2022, 0.38% were postponed, 3.04% were cancelled and 96.58% were completed as scheduled. Among cancelled in-person events in Q3, about 38% pivoted to produce digital events. Excluding postponed events, the cancellation rate reached 3.1%, as indicated previously.

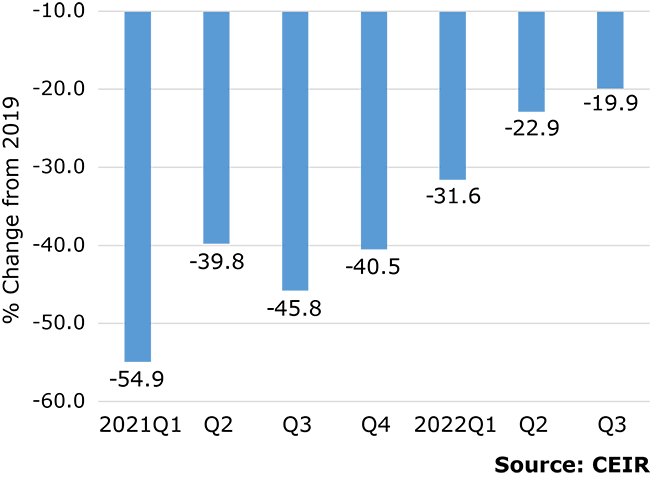

Figure 3 provides insights about events completed during Q1 2021 to Q3 2022, comparing performance of each to the same quarter in 2019. Q3 2022 results speak to a continuing but choppy and uneven recovery that is underway. Still, the direction is positive, with the overall Index and specific metrics improving for the past six quarters. Among completed events, 14% have surpassed their pre-pandemic levels of the CEIR Total Index. Some organizers launched new shows, expanded existing shows to new locations or held them at a different time of the year. When looking at results excluding cancellations, performance of events that happened in Q3 2022 documents continued improvement; it is down only 19.9% compared to 2019 (Figure 3), which is much better than the decline of 54.9% registered in Q1 2021 compared to 2019.

Figure 3: CEIR Total Index Excluding Cancellations, % Change from 2019

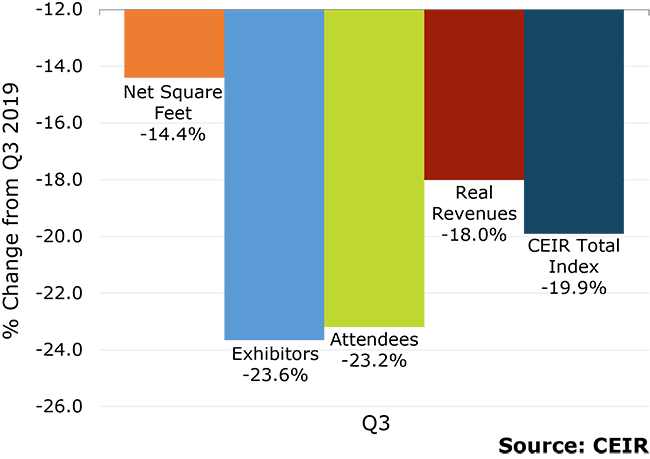

Among four metrics, Exhibitors suffered the largest fall of 23.6%, followed by Attendees with a decline of 23.2%. Real Revenues tumbled 18.0%. Net Square Feet (NSF) in Q3 was the metric that contracted the least at 14.4% from Q2 2019.

Figure 4: Q3 2022 CEIR Metrics for the Overall Exhibition Industry Excluding Cancellations, % Change from Q3 2019

Insights on a Recession

There are widespread views on whether the economy is in a recession or heading into one. The outlook has implications for the exhibition industry. In CEIR’s view, a rebound in Q3 GDP and robust payroll employment gains throughout the year, including increases in October and November of 284,000 and 263,000 jobs respectively, dispel the notion that the U.S. economy has experienced a recession up to this point in 2022.

However, persistent elevated inflation has injected headwinds into the economy, prompting the Federal Reserve to take on aggressive interest rate hikes. At their August 26th meeting, Federal Reserve Chair Powell noted the Federal Reserve remained committed to restoring price stability and bringing inflation in check. At the November 3rd meeting, Chairman Powell reaffirmed the Federal Reserve’s restrictive monetary policy stance. While the pace of increase in interest rates may slow from the December 2022 meeting onward, the level of interest rates will remain high in 2023 and with it, a cooling of the economy. The probability is about 50-50 that the economy will slide into a recession during 2023.

B2B Exhibitions Recovery

As a result, 2023 will be challenging for the exhibition industry, as the economy slows down further and businesses are more cautious. Nonetheless, “the B2B exhibition cancellation rate should remain extremely low, and the performance of completed events will continue to improve,” said CEIR Economist Dr. Allen Shaw, Chief Economist for Global Economic Consulting Associates, Inc. “A full recovery for the industry is expected in 2024.” Among 14 industry sectors that CEIR monitors, Government and Discretionary Consumer Goods and Services sectors are expected to perform better, whereas IT and Building and Construction sectors will lag behind the overall exhibition industry.

“Despite Omicron at the outset of 2022, CEIR research has documented an intent to return to face-to-face engagement at B2B exhibitions, and CEIR Index quarterly results show recovery is happening,” added CEIR CEO Cathy Breden, CMP-F, CAE, CEM. “Each quarter, the Index is showing that more business professionals and exhibitors are coming back to the B2B exhibitions channel to meet their marketing, sales and business information needs.”